Alert Fatigue Got You Hitting Snooze?

Bzzzzzzz. Bzzzzzzzzzz. Bzzzzzzzzzzzzz. Before you even open your eyes in the morning, your phone is vibrating nonstop. Is it your mom asking you if you made it home okay from your trip? Your car reminding you that you forgot to lock her doors before making your way to bed? Your building manager telling you they’re spraying for insects this morning?

Another buzz. And then another. Geezles! You feel guilty, but not enough to feel bad turning your phone off completely. You took work off this morning to actually sleep in. Jet lag stinks!

Ends up that all of those buzzes weren’t from family, your landlord or co-workers needing a lift. (Your car was legitimate though making sure you both were safe and sound … she’s so sweet).

While you snoozed, you continued to receive a series of urgent security alerts. A breach notification. A password reset request. A text from your bank. Unreal! The coffee hasn’t even had a chance to start brewing yet! Fatigue sets in.

In 2025 data breaches and scams are at record highs:

– IT Pro reported that credential theft has surged 160% this year.

– Identity-related breaches now make up 1 in 5 incidents.

– Each case of suspected identity fraud can take hours (most of which during business hours) and sometimes days and weeks to properly investigate and resolve. Federal Trade Commission survey data estimates that victims of identity theft spent on average 30 hours resolving related problems with more severe cases jumping to around 60 hours or more.

That means more alerts than ever are landing in your inbox or on your phone. Some are indeed legitimate. Your bank warning asking about the legitimacy of a transaction…legitimate. A credit card alert asking if you are in Jamaica buying lottery tickets … certainly a questionable transaction. Another website breach alert for a company you don’t recall doing business with … who knows? After a while, all of the buzzes, dings, alerts start to blur together. Which alerts are real? Which ones are scams? And what happens if you miss something important?

With so much noise going on it’s no surprise that many people are feeling overwhelmed and unsure of what to do next and that’s why scammers have started to take advantage of this new phenomenon known as Alert Fatigue.

Why Alert Fatigue is Dangerous:

– It causes stress and creates opportunities for criminals when consumers potentially ignore real alerts because they just sound like another false alarm.

– It causes clicks on fake alerts that look legitimate, opening the door to old-fashioned fraud.

– It causes a feeling of “there’s no way I can keep up with all of this monitoring.”

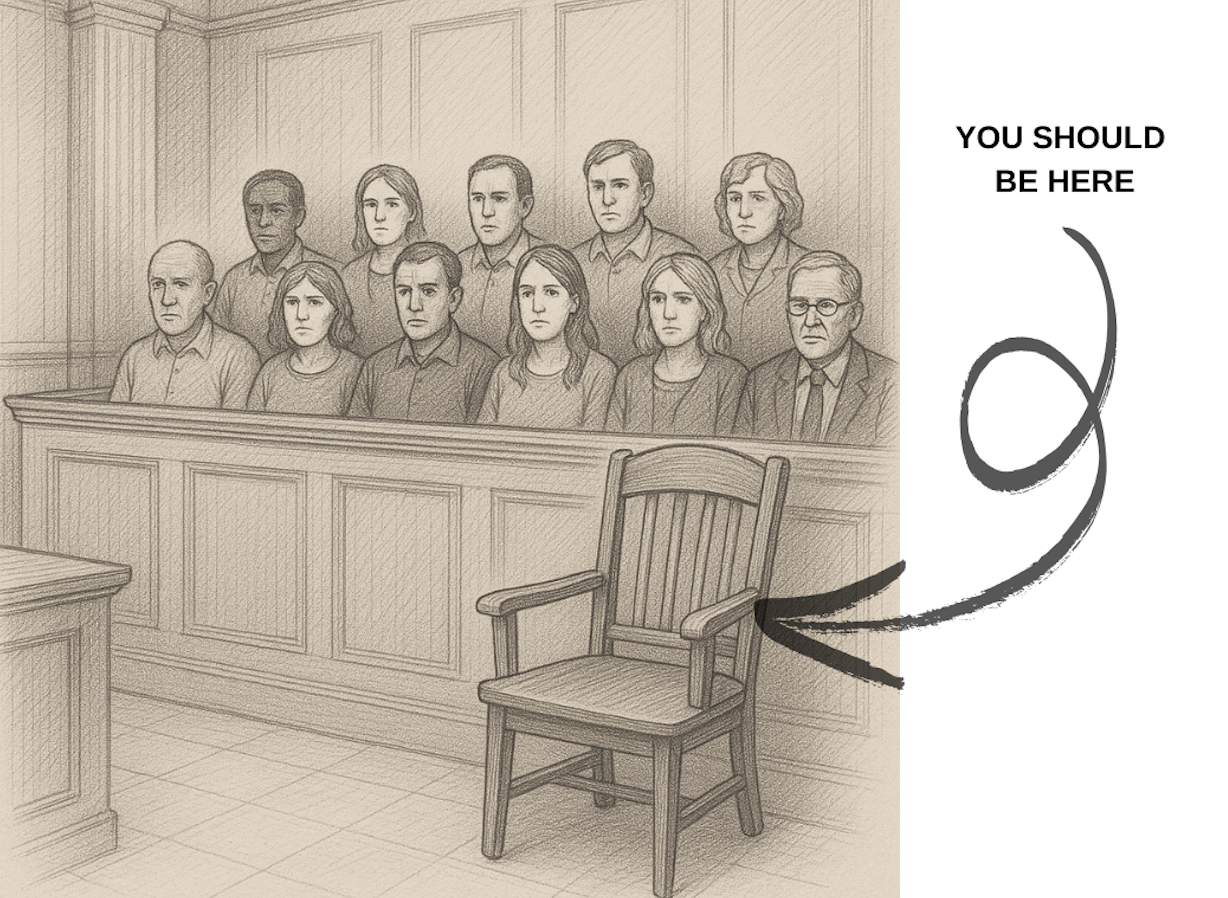

Those feelings and actions are exactly what scammers want. The more confused and exhausted you are by alerts, the easier it is for them to sneak through the phishing attacks, fake jury duty scams, or fraudulent credit applications.

The Good News:

Moving from chaos to confidence is easy. You don’t have to face the fatigue alone. At Guard Well Identity Theft Solutions, our mission is to bring clarity, confidence and resolution when all of these identity theft threats strike.

– We help you understand which alerts require action with personalized guidance.

– If your identity is compromised, we don’t just notify you. Our team in Member Services works on your behalf to resolve the fraud completely and restore your identity.

– Instead of drowning in alerts, you gain a trusted partner who knows how to navigate the system and get results. With Guard Well you’re never left guessing.

Here are a few practical tips to stay safer:

– Pause before reacting. Never click a link or call a number from an unexpected alert. Verify first through your bank or provider’s official website.

– Enable two-factor authentication. Even if your password is stolen, this adds another layer of protection.

– Use a password manager system. Strong, unique passwords across accounts reduce the chance that one stolen password will lead to multiple breaches.

– Report suspicious alerts. Forward phishing emails or texts to the proper authorities instead of ignoring them. Phishing emails came be forwarded to the Federal Trade Commission at [email protected], the Anti-phishing Working Group at [email protected], and directly to your email provider by utilizing the ‘report phishing’ option. Remember to not click on any links or download attachments before forwarding. Take a screenshot if you need to document it for your records and delete the phishing email or text after reporting.

Guard Well Identity Theft Solutions exists to protect you, your family and your employees from the damages of identity theft. Please don’t hesitate to reach out if you need help or have any questions or concerns. We are available to you 24/7/365 at 888.966.4827 (GUARD) and [email protected].