Guilty of Fraud: The Rise of Jury Duty Scams

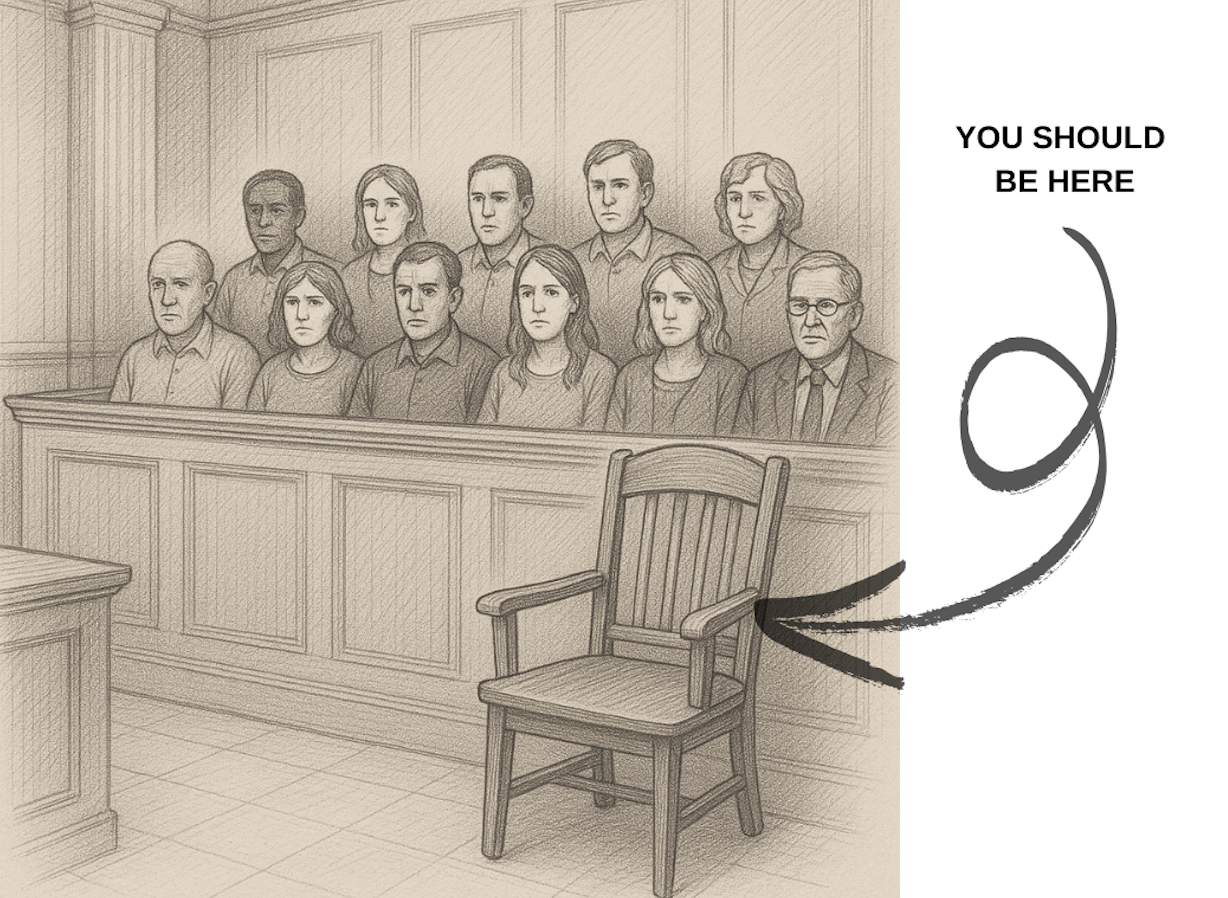

It’s Sunday night after grilling out, a perfect ending to a long, relaxing weekend. You’re listening to the opening of 60 Minutes while prepping for your Monday morning calls. As if right on cue, your phone starts to ring as the leading story sparks your interest. With one eye on the tv and the other on your phone, you don’t give it a second thought to answer the call from a number with your area code.

“I’m sorry to inform you but did you know that you missed jury duty?” the caller apologetically says.

Wait, what?

“There’s a warrant out for your arrest but here’s the good news, I can make it all go away if you pay a fine … immediately.”

Really?

“This happens all the time,” they say. “But you have choices, you can pay the fine via gift card, wire transfer or through our secure website.”

They can’t do that, can they?

Unfortunately, they’re right. It is possible to be in trouble for missing jury duty. A judge can issue a fine, contempt of court charge or even a bench warrant. The penalties vary by state and county but they are always handled formally through mailed notices or in-person proceedings.

Jury duty scams are happening all the time and they’re rising in sophistication. The Federal Trade Commission reported that “some scammers are now telling you to visit a website to enter your personal information — all so they can steal it and your money. They send you to a site that looks legitimate, with an official-sounding URL and government-looking seals (all fake). It’ll ask you to enter your birthdate and Social Security number to ‘look up how much you owe.’ It might ask you to pay up to $10,000 in fines on the site, or send you to a ‘government kiosk’ (no such thing) to pay by cryptocurrency. But every bit of this is a scam.”

Here is how the scammers are getting away with it:

Scammers make it look real by using caller ID spoofing technology so the call that comes in on your cell will have your local area code so you’re more likely to pick it up. In some cases, with a particularly sleuth-y scammer, the number calling says something ominous like ‘County Courthouse’ and it’s the actual phone number of your local court … so, even if you Google it while on the phone with them, it looks legit.

Important to know:

– Your court will never call or text people demanding money for jury duty.

– If the court needs to contact you, they will use the U.S. postal service for that.

Protect yourself:

– If someone contacts you and you do not know them or were expecting a call to verify or receive personal or financial information from you, perk up, wise up and hang up immediately.

Guard Well Identity Theft Solutions exists to protect you, your family and your employees from the damages of identity theft. Please don’t hesitate to reach out if you need help or have any questions or concerns. We are available to you 24/7/365 at 888.966.4827 (GUARD) and [email protected].